At Wright, PLLC, we have extensive experience in the area of stock option taxation. We have developed a detailed model that looks at your tax situation over a multi-year period. Often since the decision to exercise and hold, versus exercise and sell is a multi-year tax issue. The best practice is to model your decisions over a number of years to see the best possible scenario.

Our modeling tool includes the following complex areas of taxation:

- - All stock option taxation options

- - Incentive stock options (ISO)

- - Non-qualified stock options (NQSO)

- - Employee stock purchase plan (ESPP)

- - Restricted stock units (RSU)

All new 2013 tax laws for high income taxpayers, including:

- - Itemized deduction phaseouts

- - Personal exemption phaseouts

- - Net investment income tax

- - Medicare surtax on high wage earners

- - New 2013 tax rates, including the 39.6% rate as well as 20% long-term capital gain tax rate

We also integrate in the alternative minimum tax ("AMT"), as well as AMT tax credit carryovers to determine how your stock option decisions effect all areas of your tax situation.

We include in our model a forecast of the increases in tax rates and exemptions over a five year period, so you can be as accurate as possible in your tax planning.

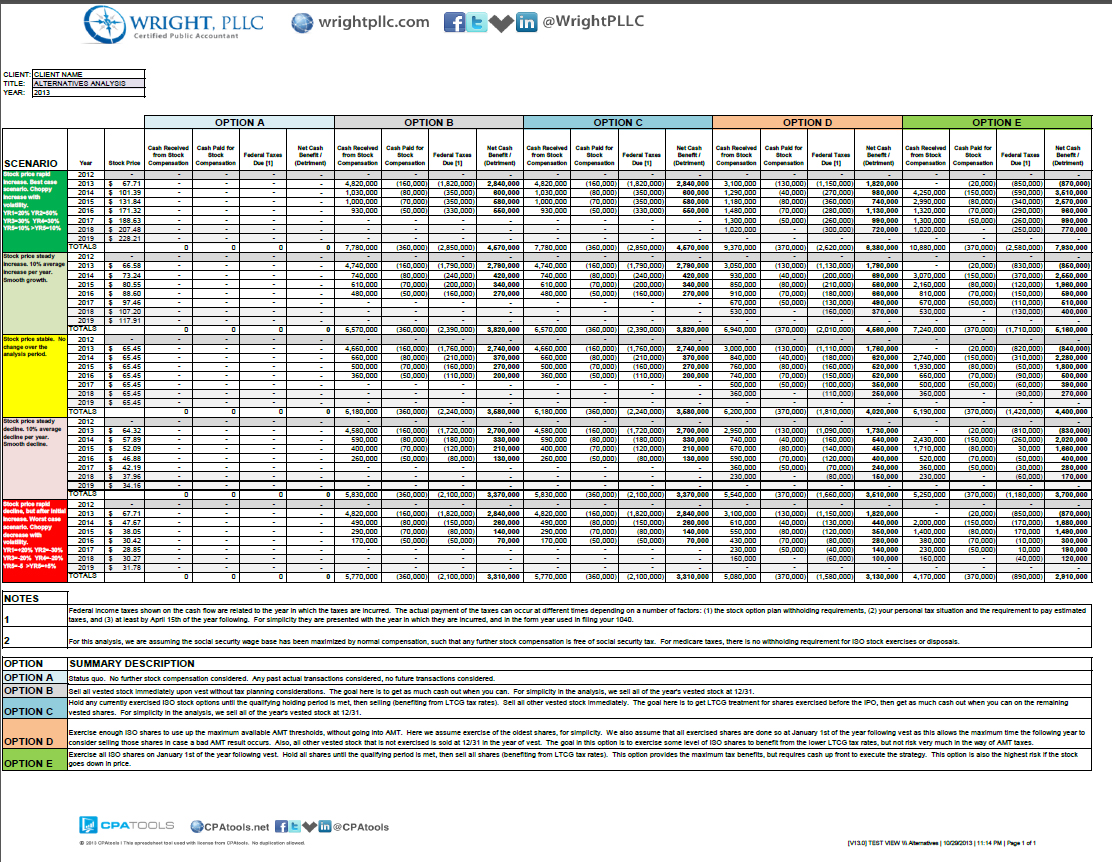

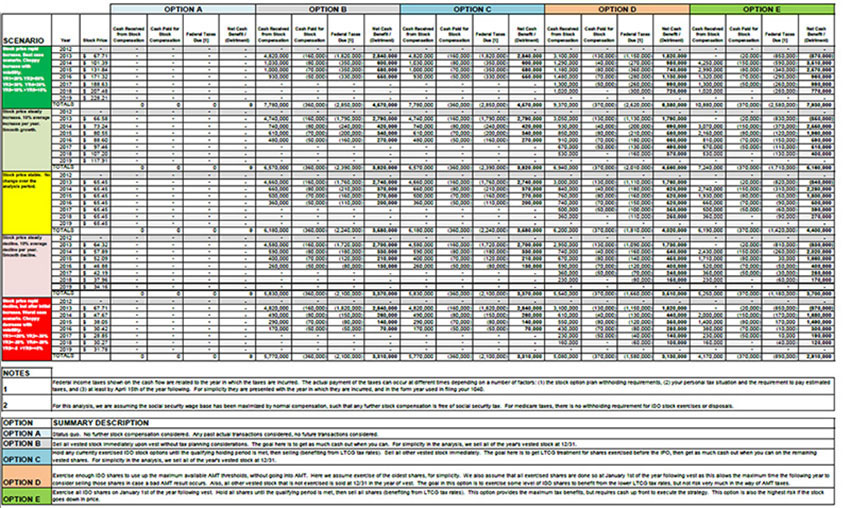

Our top level matrix summary, which includes five different scenarios (exercise/hold/sell, etc.), and compares to five different stock price environments over a five year tax period. For an example of our matrix, click below.

The development of our model took extensive efforts and testing. Included in your modeling backup, in addition to the summary matrix is a 150 page detailed PDF showing all the calculation options supporting our top level matrix of choices.

We are pricing our AMT model analysis package as follows:

Base |

$1,000 |

[Including running your tax situation through the model only] |

Customized |

$1,500 |

[Including the base model analysis, as well as customizing a plan specific to your needs. |

Difficult |

Hourly |

[If your situation is extremely complex, we are happy to consult at our hourly rates] |

You can see the value proposition to our analysis as the cost for being wrong can be significant in a volatile stock market environment.

Information required:

We will require the following information to calculate your AMT model analysis of your stock options:

1. Prior year tax return

2. Full stock option details, including as much detail as possible on your option grants, vesting, exercises, etc.

3. A copy of a recent pay stub for yourself, and spouse if married.

4. Any information on adjustments we need to make to your assumptions going forward? Any big gains coming due?

Please advise of anything out of the ordinary that would not be anticipated from a normal growth trend from your past activity.

Please contact us for further information.